I have a bias. I believe properly structured life insurance is a far better way for most Americans to save money and build wealth than the more traditional ways – like investment accounts, 401ks and others.

I have a bias. I believe properly structured life insurance is a far better way for most Americans to save money and build wealth than the more traditional ways – like investment accounts, 401ks and others.

I believe that for a number of reasons – allow me to highlight just two briefly:

- Wealth accumulates tax-deferred and is accessible tax-free – an unbeatable combination

- Money inside a cash value life insurance plan is completely immune from market risk (even though it gets the benefit of most market gains) – a huge advantage today.

I recently found myself in a debate with a Wall Street type – who clings to the notion that cash value life insurance if a rip-off. His evidence: “Because of the life insurance component, your fees are outrageous.”

The problem is – it’s not true.

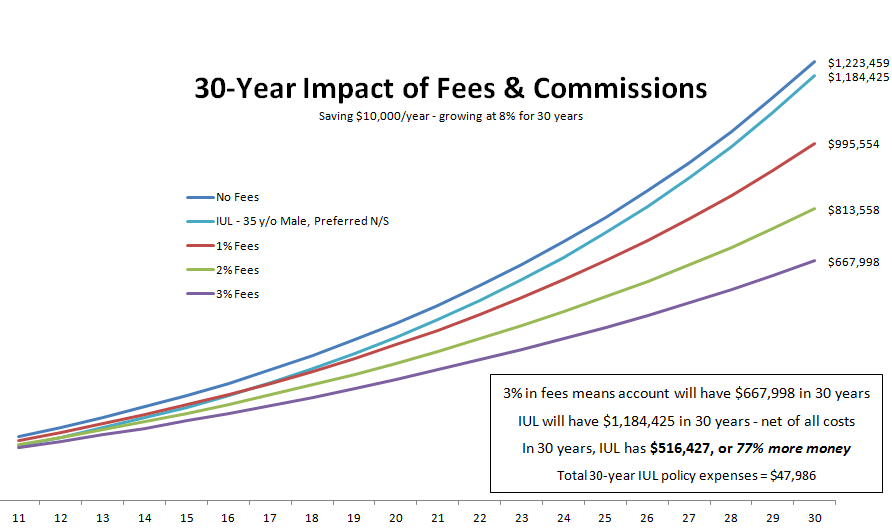

I ‘rail’ on the impact of investing fees and commissions a lot – but never have I seen better evidence to make the point than this chart.

It shows what would happen if a 35 year old put $10,000/year into the ‘market’ without any fee impact at all – versus fees ranging from 1% – 3% per year. Then it shows what would happen to that same money – growing at the same rate – when invested in a properly structured cash value life insurance plan.

- At no fees or commissions – his account would grow to $1,223,459. Let’s call that the benchmark – unachievable – but a benchmark nonetheless.

- The kind of cash value life insurance plan I advocate would have grown to $1,184,425 – a close second. The total of all fees associated with the life insurance option over 30 years would be about $48,000 – for which the “investor” would have grown his money tax-deferred, without risk, and be able to take it out tax-free.

And that leads us to the Wall Street Plan my ‘associate’ was defending.

We can debate forever what Wall Street charges their investors – but I can stack up a pile of evidence that most pay in excess of 3% of their account’s value each year. If so – our hypothetical investor would pay $516,427 more than our same guy in a life insurance plan.

That’s a half a million dollars that he can’t spend, give away, or use for income. Even at an unrealistic 1% in fees – the life insurance plan beats the Wall Street plan by nearly $200,000.

That’s a huge difference – and factors in only the fee differential. If you haven’t looked at cash value life insurance in a while – this may give you the motivation to do so.

Who would have ever thought one of life insurance’s advantages would be its low cost?