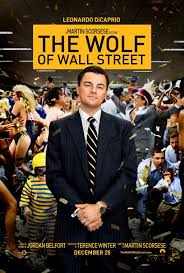

The Wolf of Wall Street – starring Leonardo DiCaprio – glamorizes crooked Wall Streeters who figure out the latest way to scam an unsuspecting public.

The Wolf of Wall Street – starring Leonardo DiCaprio – glamorizes crooked Wall Streeters who figure out the latest way to scam an unsuspecting public.

The film has drawn fire from both sides of Wall Street – including the Motley Fool – whose commentary I generally regard as quite “balanced.”

The Fool wrote an article on the movie focusing on the value of a professional Wall Street advisor managing your money.

The article asks the age old question, “Do they add more value to our portfolios than it costs to employ them?” According to the Fool – the answer is a resounding NO! In fact, of the two lessons they draw from the movie, lesson one is: “Stop paying financial advisors and fund managers to lose your money.”

They point out that in 2012, nearly two-thirds of all U.S. mutual funds underperformed the S&P 500; and over the last 10 years, that figure shrivels to less than 20%.

The primary reason they offer is that advisors’ simply cannot pick stocks the way they used to – when factors like sound research would give a hint of future stock prices. Today stocks rise and fall on events like monetary policy, foreign banking policies, political unrest, and other events that are impossible to predict accurately and translate into their impact on an individual stock.

The problem is compounded when – according to the Motley Fool – mutual funds charge an average of 1.5% of the investors account balance each year.

Consider this. The 100-year performance of the S&P 500 is about 9.6%. If we take away 1.5% in fees and commissions, we’re left with 8.1%. And if we tax that at 30%, and we’re down to 5.7% – not much for all the cost and effort.

The article concludes by suggesting that buying an index fund – where the fees are negligible, and our money tracks the performance of an index (i.e. the broader S&P 500), we’ll be far ahead in the long run.

I have a better idea. Focus on indexing that comes with an earnings floor and an earnings cap. That way we’re able to harness the power of indexing without any downside risk at all. I can show you how.