When a bank loans money – it charges interest for the use of that money. Think of interest as rent. Say we borrow $12,000 – and agree to repay it over 10 years at an interest rate of 5.46%. Based on those loan terms, our total interest charge will be $3,600, and our payment will be $130 a month.

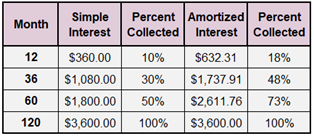

Logic would tell us that our payment would be made up of equal parts principal and interest. We assume the principal portion of our payment would be $100 a month ($12,000/120 months); and the interest portion would be $30 a month ($3,600/120 months). That way of calculating payments and parsing them between principal and interest is called ‘simple interest.’ But logic doesn’t necessarily prevail at banks. They use a calculation called ‘amortized’ interest because it collects interest faster than simple interest would allow. It packs interest disproportionately onto the front-end of the loan and collects less interest toward the back end of the loan. The table below shows the difference:

As you can see, the bank collects 73% of its total interest charge in the first half of the loan, leaving just 27% to be collected in years 6-10. As intellectually interesting as that may be, what can we learn from this that can help us?

When we took that loan out, we committed to paying $3,600 in interest. That’s the ‘rent’ the bank required we pay – and it’s the rent we agreed to pay. But we’re in control of that rent. We can pay less – after already having agreed – if we’re smart!

For example, if we were somehow able to pay the loan off in half the time, we could reduce the rent by 27%, and pay $2,600 rather than $3,600. That’s $1,000 more that we can use for our family and our needs – rather than sending it off to the banker so he can take care of his family and their needs.

That may be little more than mildly interesting – unless we know how to repay that loan in half the time without subjecting the family to major sacrifice – like eating Ramen for five years. For example, if we reduced our savings rate by $100 a month – and used that $100 to accelerate the repayment of our loan instead – we’d pay it off in 5 years rather than 10, and we’d save $1,000 in interest. If we kept saving that $100 a month instead – and grew it at the same 5.46%, compounded for 5 years, we’d earn $881 in interest.

So the choice is earn $881 – or save $1,000. You may be thinking that $100 in savings doesn’t seem like much of a reward. But consider that at the five-year mark, we can not only resume putting that extra $100 back into savings – but we get rid of that $130 a month payment. That’s like getting a pay raise of $130/month – and we get it FIVE YEARS SOONER than we would have if we’d just dutifully stuck to the bank’s payment schedule. That’s $7,800 of extra income for us. If we put it into savings also – at 5.46% for the additional 5 years, we’d have just shy of $9,000 of cash.

The ‘return on investment’ we earn by accelerating the repayment of debt is almost always much greater than we could earn elsewhere. The challenge is that most of us don’t know how to accelerate the repayment of our debt accounts without painful sacrifice and delayed dreams. By understanding amortized interest, you can focus on the payoff – and we’ll take care of the accelerated repayment mechanics.